Banking & Finance

Digital Banking & Financial Services

Pinnacle has a proven international Banking & Finance track record, with experience of providing Consulting, IT Project Delivery and Business User Services across a wide range of areas within the banking sector. Our successfully delivered engagements focus on ensuring a quality outcome, mitigation of risk, and the use of leading AI automation solutions and services to scale team capacity to reduce the cost of both effort and time to state banking departments.

AI Solutions Increase Banking Team Throughput

With a significant amount of IT budget and time being spent on new IT changes, Pinnacle enables and supports banking departments to apply intelligent automation solutions to increase team capacity and throughput via the use of virtual workers that execute tests, business processes, admin processes and reporting. This releases business users and banking professionals from the burden of low value administrative tasks to support IT project changes and increase the time available to provide high value activities associated with their day jobs.

Risk Mitigation During Accelerated IT Transitions

With increased adoption of agile and DevOps to aid rapid deployment of IT changes that transition legacy banking systems and complex integration into new era of high iterative levels of change and a transition to new digital banking landscapes.

With the adoption of high volumes of change, this equally raises the levels of production impacts and RISK within the complex integrated banking platform.

The need to effectively manage and mitigate these risks and outages to ensure quality outcomes has never been greater.

Pinnacle is an Australian specialist supplier that supports and enables banking teams to meet their digital business assurance and digital transformation challenges.

Why Pinnacle?

Pinnacle has a strong proven track record of delivering and enabling international banking and finance projects. industry experience of successfully delivering IT projects and technologies that have evolved the state business IT landscape. Pinnacle’s leading innovation and solutions, is backed up by a proven delivery capability that mitigates production and patient risk from complex IT change. We work with state banking organisations to reduce the time, effort and cost of achieving their digital outcomes whilst mitigating their operational risks through accelerated business assurance outcomes.

Pinnacle Accelerating Digital Business Assurance

and Quality Engineering Outcomes

Consulting Services

Consulting Services

Project Delivery Services

Project Delivery Services

Managed Services

Managed Services

Platform Subscription Services

Platform Subscription Services

Our Core Capabilities

Strategy, Assessment and Advisory

Strategy, Assessment and Advisory

Independent Business Assurance & Governance

Independent Business Assurance & Governance

Quality Engineering

Quality Engineering

Intelligent Delivery Automation Services

Intelligent Delivery Automation Services

Performance Engineering

Performance Engineering

Environment & Data

Environment & Data

Intelligent Business Automation Services

Intelligent Business Automation Services

Tooling Platform as a Services

Tooling Platform as a Services

How are we different?

Significant

International Experience

Pinnacle consultants and associates are senior thought leaders within the industry. Through business consulting and AI we assist clients to achieve IT transformation at speed, improve their agile and DevOps maturity, work practices and capabilities.

Project and

Services

Pinnacle have a proven international client project and service delivery track record spanning more than 30 years within the Banking and Finance industry sector. We focus on risk mitigation and seamless transition between legacy and new technologies.

Innovation not

Technical Complexity

Pinnacle supports and drives improved team capability, and collaboration between non-technical, business teams, and IT teams. Business users focus on their day jobs, and our AI and codeless solutions substantially increase speed and reduce costs.

Improved Teams and

Delivery & Business Effectiveness

Pinnacle defines improvement and transformation roadmaps that improve team skills and capabilities to mitigate risk, increase throughput and reduce costs. Our methods improve agility and collaboration within IT, non-technical and business teams, via AI and transformation lifecycle solutions.

Banking Consumers of Pinnacle Services

Chief Technology Officer

With the ever increasing pressure to see successful implementation and adoption of digital systems, without negative local or national press has never been greater. CTO’s and their budgets are under the spot light as demand for “complex integrated digital” services increases to be critical to the success of delivering modern customer and business banking.

Continuous change and rapid implementation and integration of complex banking platforms, old and new continually increase the risk of impacting key business functions, increases the risk of production failures from defect leakage. Whilst business teams within the bank are often required to spend time continuously supporting IT change projects rather than focusing upon their own critical job role activities.

CTO’s juggle a challenging ever shifting landscape, where improved digital business assurance is of paramount importance to managing risk, quality, cost and speed of delivering IT Change. Pinnacle consultancy and services enable CTO’s and their IT teams to directly address these challenges and enable effective and scalable quality banking transformation at speed without increasing production risk. PinnacleQM do this by leveraging our international industry experience, providing our leading expertise, innovation and solutions, that allow banking teams to achieve their digital outcomes.

IT Project Teams

IT project teams within digital baking programs are at the forefront of needing to implement and deliver successful digital health programs.

Pinnacle work with IT project teams to support and enable successful delivery of their digital health programs. Pinnacle inSight consultancy provides strategy and direction in Agile, DevOps and AI Automation. Whilst Pinnacle delivery services support banking IT project teams to mitigate change risks with leading digital business assurance services, and industry leading AI automation solutions that scale IT project team throughput and capacity to meet the increased demand and in IT changes.

Business Teams

Pinnacle works with and helps business teams to significantly reduce the time and effort burden of supporting IT projects down to as little as possible, whilst significantly improving quality outcomes and team viability. Pinnacle ensures that we use our experience, frameworks, IP, accelerators and AI automation platforms to drive the maximum value out of every hour with the business banking teams and that the IT change process as never wastes the time of these critical resources and minimised their time out from their important patient duties. In addition, our consultants work with banking teams to apply leading automation solutions to reduce time consuming repetitive administration tasks. This increases focus, time and effort on greater value direct patient care tasks and activities.

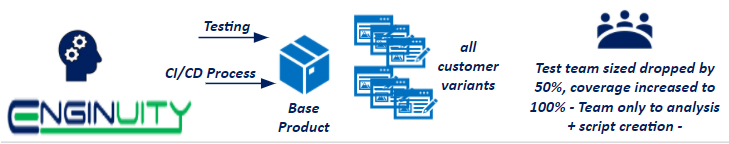

Banking & Finance Software Companies

In the competitive marketing of providing specialist software solutions to the Banking and Finance industry the time, effort and cost associated with the implementation, migration and integration of the product is as critical as the on going cost of ownership. Banks are selecting their products based upon the low risk and cost profiles, and Pinnacle helps Software Companies be competitive, win and retain more clients.

We work with specialist software solution companies, to ensure that they can reduce the risk, duration, effort and cost that block the purchase of their products. We are able to support and enable their project implementation and deployment teams to ensure that deliver with agility, scalability, capacity and throughput that only our leading AI automation services and experienced teams can provide. We are also helping vendors validate their integrated end to end processes and get quick and efficient user acceptance for the new implementation of the systems.

In the true spirt of partnership Pinnacle goes beyond helping its Software customers to successfully implement there solutions.

We work in partnership with our clients using of our industry leading AI automation platforms to quickly and efficiently QA and validate all their products (base versions), along with each specific client variant build.

These Pinnacle services ensure that our customers within an Agile world of rapid change can validate and regression test all product and integration changes, along with frequent product patching and enhancement changes within hours and deploy with confidence.

Pinnacle Innovations and Accelerators

inSight Consulting

Accelerators

Accelerators

- strategy & advisory engagement, workshop and delivery frameworks & templates

- review & assessment engagement, workshop and delivery frameworks & templates

- assurance & certification industry standards & compliances frameworks

- transformation engagement, workshop and delivery frameworks & templates

- transformation journey roadmaps (AS IS, TO BE) frameworks, standardised metrics tracking and reporting templates

IT & Business

Agility Frameworks

Agility Frameworks

- IT agility framework for improving IT project delivery maturity and efficiency

- transformation and adoption frameworks for applied intelligent automation to IT lifecycle

- business agility framework for team adoption of agile business practice’s, skills and structures

- team skills development capability, structures and support for both IT and business teams

Automation

Accelerators

Accelerators

- automation strategy and product selection frameworks

- machine learning and automated application UI and end to end banking processes using Enginuity AI automation platform for a number of vendor applications

- automated key banking & finance processes available out of the box

- automation of IT delivery processes available out of the box

- online dashboards, metrics tracking and reports all available out of the box

Banking Data

Standards

Standards

- LixSim automation strategy and implementation framework and automation solutions for LIXI bank lending messaging standards

- LIXI automation client pilot accelerator framework, ROI and business cases templates

- industry leading AI automation platform enabled via LixSim for LIXI message, API and interface testing

- industry leading AI automation platform enabled via LixSim for automation of volume banking test data creation, and obfuscation of production data

Delivery and

Transformation Kitbag

Transformation Kitbag

- service catalogues to enable reduced lead-times and agile delivery engagement

- IT and business engagement and delivery templates, metrics tracking and reports

- all leading vendor, open source and PinnacleQM AI automation platforms and integrations all available on AWS, Azure

- out the box platform as a service capabilities

AI Automation Innovation

Applying Advanced AI Automation provides a unique capability to enable collaboration between agile IT and business teams.

Overcome banking and finance challenges within digital transformation projects, and provide improved team scale, capacity and throughput via the use of intelligent automation to significant de-risk change.

central command

console

console

- supports FULL IT life-cycle

- manages reuse of assets across all products within the life-cycle

- ground-up developed agile tool

- integrates via API to external systems

- supports agile & waterfall projects

- platform schedules automation runs

- reports and dashboard output

- conversion from HP ALM and others

- API Integration with ‘third party’ products and tools

AI automation for

IT project development & testing

IT project development & testing

- natural language test scripts, with NO technical test tool scripts to create or maintain

- team collaboration for Agile & DevOps

- supports ANY application technology

- SIT test automation across applications

- scaled virtual tester execution, ALL tests executed in hours

- integration to physical device labs

- comprehensive reporting dashboards and defect management

AI automation of banking & finance

data obfuscation and LIXI messaging

data obfuscation and LIXI messaging

- unpack & sort production LIXI messages by type

- smart obfuscation of sensitive and patient personal data from testing retains future obfuscated data integrity

- automatic creation of:

- test scripts

- test expected results

- comparison testing

- parallel multi point verification (legacy, test & pre prod environments)

AI automation for agile

business user acceptance

business user acceptance

- reduces business user effort on UAT from months of work down to days

- collaborative and clear acceptance driven delivery model

- automated execution of test cycles

- online review of real time evidence capture linked to acceptance criteria

- online report generation and sign off

AI automation applied for

business process automation

business process automation

- automated high volume and repetitive banking transactions and end to end processes

- supports full stack automation of banking application, interfaces, integration and messaging

- advanced capability in document and object recognition

- attended and unattended automated processing

- non technical business user creation and maintenance of automated processes

Enginuity applied automation for digital banking projects

Applying Intelligent AI Automation

within testing of Digital Banking

Read More

Automation testing of full stack application technologies

- application UI (all technologies)

- Interfaces, integration & end to end processes

- comms & message layer

- API, services & replicated service calls

- databases, data sources & data objects

Enginuity automating the test process not just the testing

Intelligent automation services for migration and mergers, automating the validation of System, Integration, Data and Business Processes.

Enginuity automatically created automated Migration test scripts

0

Banking Customers

0

Customer bank accounts

0

Automated test scripts created

0

ALL in mins

execution

0

tests run

per day

per day

“Organizations must deliver agile projects with speed, high quality and minimal rework.

This challenge is driving the need for increased automation. Intelligent automation provides huge potential for greater productivity and efficiency in application testing, at a lower cost”.

Authorise Reduces The IT Change Burden on Banking & Finance Business Teams

Pinnacle’s “Authorise” AI automation platform is improving collaboration, engagement effectiveness and reducing the time and effort in business teams supporting user acceptance activities within IT change projects.

improve Collaboration in

Supporting IT Change

Collaboration & clear communication with non technical business teams, and save time via the use of the Authorised non technical, automated acceptance framework. Real-time video evidence capture, online dashboards, reports and sign off capabilities. Reducing time and effort required to support IT projects, and allows increased ward duty time.

Improve Banking Professional

Utilisation In IT Projects

Acceptance driven testing using the Authorised framework and tools, automates the user acceptance process providing real time video evidence of signoff & approval. This approach significantly reduces the need to pull business teams from their day jobs for each agile project sprint. Allowing effort and time to be focused back upon high value business user day job activities.

Rapid Certification and

Compliance Assessment

Create bespoke client centric certification criteria, or upload industry compliance or regulatory requirements. The Authorised Framework Tools automates the certification and execution process, whilst providing the results within the online evidence dashboard.

Intelligent Automation For Banking and

Finance Business Brocesses

repetitive

IT tasks

Automated everyday IT administrative tasks, build and deployment activities, security and reporting.

repetitive

business tasks

Automated administrative tasks, reporting, order processing and invoicing.

Data Capture

and Reporting

Capture system or file data, conducted automated data entry and automatically collate data from multiple sources for report generation or record creation.

automated cross

system processing

Automation of business processes across system landscape, integration and technologies.

Enabling teams to create and maintain their own automated processes, with the use of simple natural language work instructions and no technical code to create or maintain.

end to end

24/7 processing

End to end process automation services that deliver upon a 24/7 basis against service levels and throughput/ capacity agreements.

Automating across business departments, and out to external services and partners

– We can support that too.

Scale Capacity & Throughput Of Banking

and Finance Business Teams

Enabling business teams, departments to scale throughput & capacity via innovation in technology not increased team hiring costs.

Free up business professionals from mundane, repetitive administration and project support activities to focus on value add business activities. Same team sizes with increased throughput, capacity and productivity.

managed automated banking

& finance processes “as a service”

Customers reviewing and defining their business strategy often focus upon driving efficiency and productivity gains as a means to lower cost, often choose to remove the need to process and own the administration of NON CORE Business Functions. Freeing up their budgets and teams to focus on more valuable and productive business and end customer improvement activities.

Business Process “Slithers” for a given organisation are defined, ringfenced and then delivered as an Automated Services. The move to Pinnacle managed automated business process services facilitates this business outcome and ensures that the business processes that are provided as a service are managed in line with business change, and operate 24/7 against service schedules & SLA’s.

Remove repetitive high volume low value administration tasks

Significantly reduce processing time over manual activities

Increased throughput and removal of process backlogs

Automated process is cheaper to run than the manual workforce equivalent

No downtime, personnel costs, working hour constraints, equipment or office overheads

Enginuity

thinking differently about test automation

automated conversion of selenium tests to Enginuity

0

Selenium

automation tests

automation tests

0

lines of selenium

code to maintain

code to maintain

0

test

steps

steps

0

ALL in

mins

mins

lines of technical code in Enginuity

0

Enginuity AI automation platform

runs it all with NO code

runs it all with NO code

Enginuity Virtual Testers

automating the test process not just the testing

automated conversion of selenium tests to Enginuity

Unlimited

0

lines of selenium code to maintain

0

test

steps

steps

0

ALL

in mins

in mins

lines of technical code in Enginuity

0

Enginuity AI automation platform

runs it all with NO code

runs it all with NO code

case studies

Test Automation of the End to End Lending Process

Client Challenge

- Australian bank using an offshore team of over 100+ to conduct quarterly releases of the banks end to end lending systems

- Offshore ISV provider struggling with technical complexity, script level maintenance and continual team size growth with an ever increase script pack to maintain

- Challenges in moving to daily and weekly releases with traditional automation and large team utilisation

- Test team maintaining between 500x and 10,000x more lines of code in test automation tool scripts than lines of code within the applications under test

Solution

- Replace all the existing complex API, integration and open source tools, Selenium and TOSCA automation solution with Enginuity

- Migrate technical coded tool scripts from old tools into natural language modular Enginuity work instructions (no technical code)

- Use Enginuity to automate the entire end to end lending process, including LIXI messaging, integration, external interfaces, and databases, across legacy, web, and mobile technology platforms

- Virtual testers scale to execute over 50,000 end to end transactions per day

Client Benefits

- PinnacleQM team of 12x local onsite test team replace the 100+ team offshore

- Time, Cost and Duration savings over incumbent offshore provider

- Daily and Weekly test cycles with push to production achieved

- Improved risk mitigation to production, with no limitation on test coverage

- Virtual testers scale to meet the level of testing, and run on a 24/365 basis

- Fully integrated into a formal Agile and DevOp’s CI/CD pipeline process

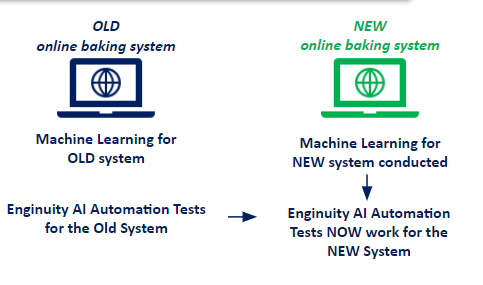

Implementation and Migration Of a New Internet Banking Platform

Client challenge

- High risk customer facing project change, against challenging project durations

- Technical complexity, integration and data integrity where increasing project risks and increasing planned project durations

- Limited experience in defining a clear strategy for mitigation and testing program risks

- Medium to Low agile maturity and traditional automation techniques only

- High level of business user resource utilised throughout the project sprints

- High cost to cover business teams supporting IT projects

Solution

- Automated validation of migrated customer accounts

- Enginuity created ALL Migration Validation Test Scripts (zero human effort) to verify that all user accounts were correctly migrated over to the new target system

- Enginuity Automated testing utilising integration with Perfecto Mobile Device Labs

Client Benefits

- Over 1.5 Million dollars saved through 35+% saving on total planned project duration

- Daily build and test cycles

- 45+ man months of regression testing conducted each cycle within 3 hours (unmanned out of hours)

- 924 days of business user effort saved from Authorised acceptance driven delivery for UAT, Sign Off and Approval process cut business user involvement of 7days from planned 40+ days.

- 100% of testing conducted was automated. Including, migrated Internet Banking Platform, E2E validation of entire lending process, including all defined browsers, mobile apps and devices

- Zero human effort, Enginuity created ALL migration validation test scripts to verify that all user accounts were correctly migrated over to the new target system.

- 40,000 validation checks within 3 hours, executed automation progression and regression tests

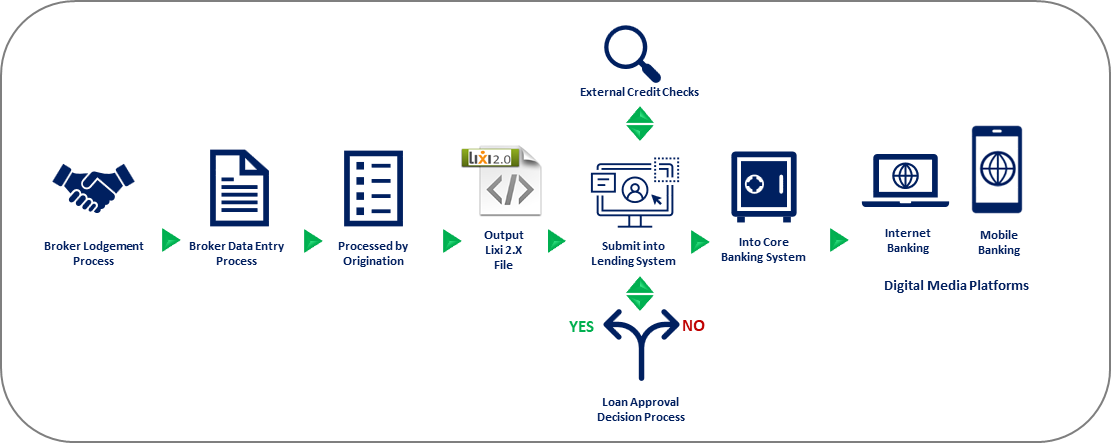

Credit Applications

Client challenge

- The mortgage origination and approvals process is complex. Lending systems interact with 3rd parties to verify Payslips, Addresses, Credit Ratings, TFNs, Driving Licences and Customer Personal and Financial Data.

- Obfuscation of real customer data while retaining meaningful integrity for testing the end-to-end Lending process is difficult and costly.

- Demonstrating compliance to financial regulations and Data Privacy is an additional layer of governance for the ongoing delivery of financial systems

- Repeatedly using the same data changes the test outcome. A given applicant can only make a number of applications before the credit process blocks the customer.

Solution

- Standard Enigma obfuscation removes all references to real customers personal, address, relationships etc.

- Advanced Enigma obfuscation dynamically changes customer test data to reliably interoperate with 3rd party applications and ensure reliable test outcomes.

Client Benefits

- Reliable automated testing with sanitised, realistic data can be conducted across the end-to-end Lending process.

- Standard and Advanced AI obfuscation can be customised for each customer so the resulting test data set is relevant to their business geography and regulation.

voice of the customer

-Australian Bank -

CIO

"As a lending specialist within the banks lending group, we are focused on ensuring we provide and processing all our customers loan requests quickly and accurately. In the new agile world we are required to support a lot IT project changes.

Previously we would document all our tests and then technical IT teams would then convert these to automation code. Now we Enginuity we just upload our business and application tests to the Enginuity automation tool and it is executed without all the effort and time wasted trying to get IT to understand what we needed testing"

Previously we would document all our tests and then technical IT teams would then convert these to automation code. Now we Enginuity we just upload our business and application tests to the Enginuity automation tool and it is executed without all the effort and time wasted trying to get IT to understand what we needed testing"

- Banking -

Lending Specialist

"I don't know where to begin, I don't usually write references to people or companies. I was a little sceptical about what Pinnacle was saying they could offer us at first. However, now am amazed at how good they ore and how easy they are to work with. They get stuff automated, working and robust where the BIG BOYS in the market fail. They have great tech and a great team"

- Banking -

Corporate Al and Automation Services

"Great job from the workshops through to close. Great tool, even I could use it! ;of Great visibility and communication keeping us up to date. I like that 1 only had to spend a little time providing input into the project and then conduct a few hours of UAT once we had visually seen the acceptance videos "pass". Nice Touch! All the team here hope all projects run like this in the future..."

- Banking -

Credit Team

I was able to sleep the night before cutover with confidence knowing every financial transaction for every customer account had been verified"